10 REASONS YOU NEED TO USE PIGGYBANK IN NIGERIA

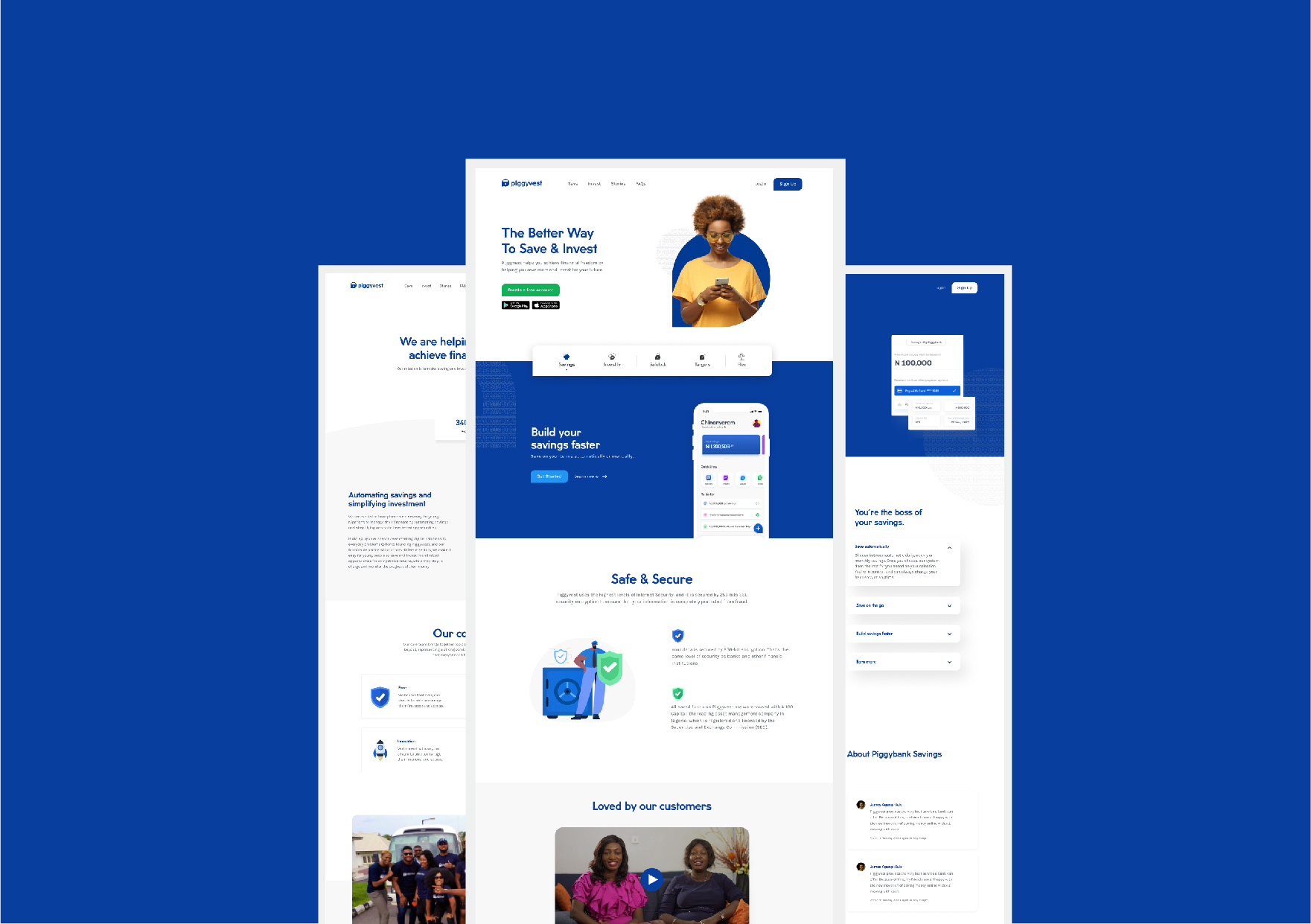

Piggybank is an online bank that helps you save money like the normal commercial banks, but with other added benefits – and without the crazy bank charges that apply in the case of commercial banks! It is an innovative, digital and new school way of saving money and performing other online payment transaction. The platform challenges you to save and helps to imbibe a saving habit in you. Piggybank does not only help you save, but also helps you invest it. They come up with different investments from time to time that allows you make your money work for you. The name was changed to Piggyvest just to accommodate the investment aspect of it, because it normally used to be just savings.

It helps to curtail unnecessary and excessive spending, and also allows users save towards specific goals and targets. The app has taken savings from the difficult process it used to be, to a fun and convenient method. On Piggybank, you can save daily, weekly and monthly, and anytime you want to. You also get up to 12.4% interest per annum on any amount you save on the platform. This is unlike the normal commercial bank that still removes charges from your money. You can set an automatic target on the platform that saves a specific amount of money for you per day r per week, this saves you the stress of having to remember when to save or not.

Click here to see how PiggyVest works.

10 REASONS YOU NEED TO USE PIGGYBANK IN NIGERIA

10 REASONS YOU NEED TO USE PIGGYBANK IN NIGERIA

Piggybank might not be a bank as it were, but it is a partner with United Bank for Africa (UBA). The funds are monitored and saved by UBA, so the app does not have access to your savings. It’s more like you’re saving indirectly to a bank. With Piggybank, you can lock some funds away and you won’t be able to have access to it for a designated period of time which you have set. It drives commitment and discipline for saving.

Why you should use Piggybank

- You earn points for saving

With Piggybank, you don’t just get to save, but you also get points for saving. And the points can be converted to cash and saved in your PiggyFlex account, which can be withdrawn anytime. The PiggyFlex account is where you keep money that you might need anytime and withdrawal is free. The interests on your savings monthly are also saved in the account. The accumulated bonus points for saving can be converted to cash and used for airtime and data. This feature of earning points for savings encourages people to save as they will be willing to enjoy the benefits which does not come with saving in a normal bank.

- You earn referral bonus

When you refer people to use Piggybank and they register through your referral link or phone number, you both earn referral bonuses. Both you and the person you referred gets a bonus of N1,000 which is immediately credited into your account as soon as the person completes his/her registration. This is a way to bring in more users for their app but it also fetches you some money as you can refer as many people as you can, and earn from all of them. You can start earning immediately

- Transparency of transaction

There is no problem with having incomplete funds on your savings. Every month, you get a breakdown of how your interest was added to your savings. The interest is daily and you get a breakdown of how much was paid daily to you as the interest on any amount you saved. You can also get a track record of all your transactions from the time you started saving till the present moment. All your bonus points from saving, when someone registers through your referral link, or when someone pays directly to your Piggybank account can be seen.

- You can set a target and withdrawal date

Piggybank has their own withdrawal dates, but you can also set your own dates if you want it different from the provided one. The withdrawal dates by Piggybank are four times in a year (the last day of March, June, September, and December). You can also set target savings of a particular amount which allows you to be able to commit yourself to regular saving. The target can be named, for instance, for a land or a house, or whatever you want to save for. If you attempt to withdraw outside the target date you set, or the withdrawal dates, there will be a penalty. Click here to see how PiggyVest plans look and hear from the horse’s mouth.

- Penalty for not following your plan

If you set target for your savings and do not wait till the target date before you withdraw, Piggybank charges you 5% of any amount you wish to withdraw. The same goes for your withdrawal too. If you choose to withdraw outside the Piggybank dates, or the dates you set, there will also be a 5% charge deducted from your money. The penalty is a way of making you stand by your commitment and making you disciplined. So if you do not want to sacrifice any percentage of your money, you will have to wait till your withdrawal date or the target date you set.

- Earn higher interest rates

Piggybank saves your money for you and gives you interest on your savings. It pays you 10% for core savings and target savings. Safe lock pays over 13% interest rate. The interest rates of Piggybank are higher than you can get from any commercial bank and this is one major reason you should save on Piggybank. The money in your Piggybank account grows more and faster than that in commercial banks.

10 REASONS YOU NEED TO USE PIGGYBANK IN NIGERIA

10 REASONS YOU NEED TO USE PIGGYBANK IN NIGERIA

- Save for the future

The target savings is a way for you to save for the future as it offers 10% interest rate for any amount you save. If you’re saving towards a particular event or a gadget, you can target an amount for it and be sure to keep to it. You can see your progress on your target so you know where you are and where you still have to go. You can also track the amount of interest that has been accumulated to your savings from time to time.

- Different saving plans

Piggybank is not a one-way saving. There are different saving plans with their individual interest rates. There is core savings which is the money saved through AutoSave or Quick Save. AutoSave is when you set a specific amount for Piggybank to remove from your bank account daily, weekly or monthly. Quick Save is when you save by yourself anytime you have some spare cash. There is also Safe Lock which is when you decide to lock some amount of money away for a particular time. It gives you about 15.5% interest rate. It works like the normal Fixed Deposit Account we do in commercial banks. Your interest is immediately paid into your PiggyFlex account while the amount you lock away stays there till the time you set for it.

- Savings challenge

You can start a savings challenge with a friend where you decide to save a particular amount of money consistently for a certain period of time. This can also be a form of target savings where you all save towards a specific goal. It is a group saving which can also be used by a group of people saving towards an investment opportunity that requires that they put funds together to achieve it.

TOP 11 REASONS WHY USERS ARE BECOMING ADDICTED TO PIGGYVEST AND WHY YOU SHOULD CARE

TOP 11 REASONS WHY USERS ARE BECOMING ADDICTED TO PIGGYVEST AND WHY YOU SHOULD CARE

- Investment options

Piggybank is featuring more investment options for their users. You can choose from the many available options, anyone that suits you. There are investments in small businesses, real estates, shares, stocks, and the likes, which you can invest in.

There is no point procrastinating. You can sign up now with PiggyVest and see for yourself. Click here to sign up now.

Instruction after signing up to redeem your free N1000

Hello. When someone signs up to Piggyvest using your referral link, you and the person you referred both get N1000 each in your safelock.

This gets sent to your flex account 10 days after the referred user has been marked valid. To be considered a valid user, your referral would have to

Have:

1.) Linked their BVN to their Piggyvest account

2.) Funded their flex naira wallet with at least N100 from their bank account using their flex account number

3.) Funded any other two wallets with at least N1000 each. Wallets may be Target savings, safelock, piggybank

4.) Leave funds untouched for at least 10 days.

Once all these are done, your referral safelock gets unlocked and sent to your flex naira wallet. Your referral safelock will roll over every 10 days until all the requirements are met.

Read Also: Piggyvest-frequently-asked-questionsfaqs-and-how-to-save-and-invest-through-piggyvest

Related