40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

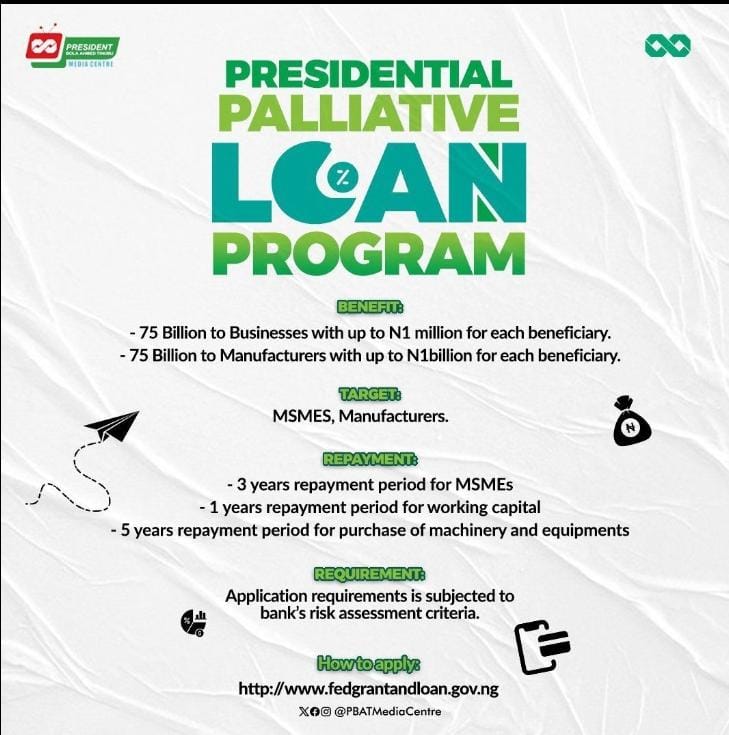

As part of the Presidential Palliative Programme, the Federal Government of Nigeria has announced the kick-off of two programmes targeted at alleviating the impact of the fuel subsidy removal – the Presidential Conditional Grant Programme and the Presidential Palliative Loan Programme.

The Presidential Palliative Loan Programme will allocate N75 billion to Micro, Small, and Medium-sized Enterprises (MSMEs) across various sectors and an additional N75 billion specifically to manufacturers. The loan, provided at a single-digit interest rate of 9% per annum, aims to support businesses in navigating the subsidy removal impact.

MSMEs can access loan facilities up to N1 million with a repayment period of three years, while manufacturers can access up to N1 billion for working capital, with a repayment period of one year for working capital or five years for the purchase of machinery and equipment.

Interested MSMEs and manufacturers can submit their loan applications through the designated portal. The funds will be accessed through their respective banks, with applicants required to meet the risk assessment criteria set by their banks.

In line with its commitment to fostering economic development, entrepreneurship, and financial empowerment, the Federal Government anticipates that these initiatives will stimulate entrepreneurship and contribute to job creation.

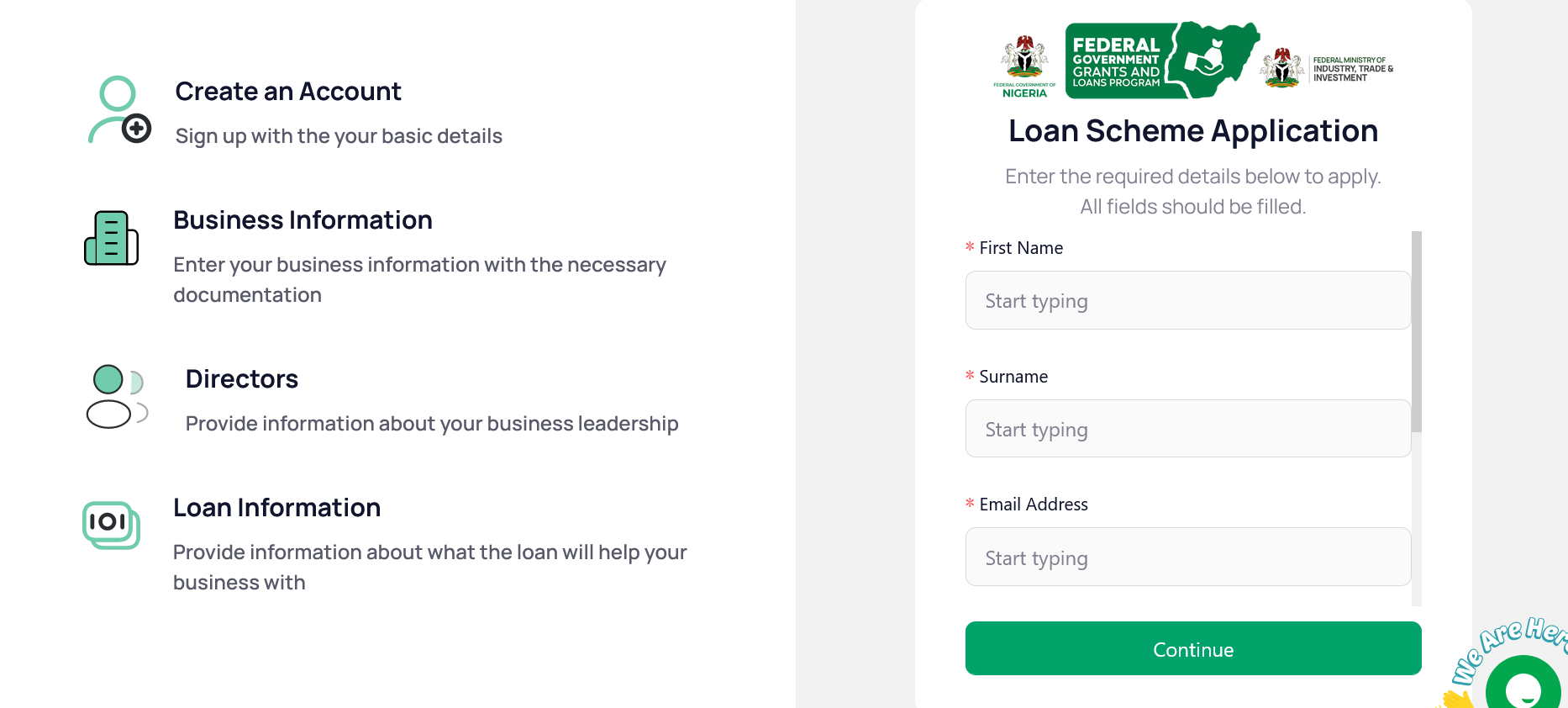

The Loan Scheme Application Guide is here

· Create an Account

- Sign up with your basic details

· Documentation

- Provide the necessary documentation

· Business Information

- Enter your business information with the necessary documentation

· Loan Information

- Provide information about what the loan will help your business with

· Directors

- Provide information about your business leadership

· Loan Details

Fill the details below.

Loan type

Start-up (MSME) (N500,000 – N1,000,000)

Existing Business (MSME) (N500,000 – N1,000,000)

Working Capital (Manufacturing) (N500m – N1b)

Asset Finance (Manufacturing) (N500m – N1b)

40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

Before you apply, here are the 50 things you need to know and have before you apply.

Business Information

1. Business type

Sole Proprietorship Partnership Limited Company

2. Company Name

3. Registration Number

4. Date of Birth

5. Gender

6. Phone Number

7. Certificate of Incorporation

8. Status Report/ Other CAC documents

9. Business Operations Address

10. Select State

11. Select LGA

12. Business Sector

Trade Transport Food Service Artisan Creative Arts

13. Bank – Choose from the list of participating banks

14. Account No

If you don’t have an account with any of the participating banks listed, choose a preferred bank from the list and create an account with them. Come back and fill the account details section afterwards.

CHIEF PROMOTER/DIRECTOR

15. First Name

16. Surname

17. BVN (11 digits)

18. Date of Birth

19. Email Address

20. Phone Number

21. Means of ID

22. Passport Photo

23. Loan Details

Fill the details below.

Loan type

Start-up (MSME) (N500,000 – N1,000,000)

Existing Business (MSME) (N500,000 – N1,000,000)

Working Capital (Manufacturing) (N500m – N1b)

Asset Finance (Manufacturing) (N500m – N1b)

Request Loan Amount

₦ 1000000

Interest

9%

Monthly Repayment Amount

₦32,000

Tenor

36 Months

Moratorium

Immediately

I have read and agreed with the terms and conditions

40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

40 Things you need to know and have before applying for Presidential Palliative 1Million to 1Billion Loan in Nigeria in 2024.

24. Please check here to indicate that you have read and agree to the terms and conditions related to this Presidential Palliative Loan:

25. PAYMENT

The loan amount shall be due and payable, at a single-digit interest rate of 9% per annum. The loan amount could be taken as working capital or for asset financing. The working capital facility shall be repayable in 2 years from the date of the issuance of the loan. While the asset financing facility shall be repayable in 5 years.

All payments made by the Borrower are to be applied first to any accrued interest and secondly to the principal balance.

26. INTEREST

As indicated in paragraph 2 above, the loan amount shall be due and payable, at a single-digit interest rate of 9% per annum. The rate must be equal to or less than the usury rate in Nigeria.

27. PREPAYMENT

The Borrower has the right to pay back the loan in full or make additional payments at any time without penalty.

28. REMEDIES

No delay or omission on the part of the Lender in exercising any right hereunder shall operate as a waiver of any such right or of any other right of such holder, nor shall any delay, omission or waiver on any one occasion be deemed a bar to or waiver of the same or any other right on any future occasion. The rights and remedies of the Lender shall be cumulative and may be pursued singly, successively, or together, in the sole discretion of the Lender.

29. EVENTS OF ACCELERATION

The occurrence of any of the following shall constitute an “Event of Acceleration” by the Lender under this Agreement:

- a) Borrower’s failure to pay any part of the principal or interest as and when due under this Agreement; or

- b) Borrower’s becoming insolvent or not paying its debts as they become due.

30. ACCELERATION

Upon the occurrence of an Event of Acceleration under this Agreement, and in addition to any other rights and remedies that Lender’s may have, Lender shall have the right, at its sole and exclusive option, to declare the loan amount immediately due and payable.

31. SUBORDINATION

The Borrower’s obligations under this Agreement are subordinated to all indebtedness, if any, of the Borrower, to any unrelated third-party lender to the extent such indebtedness is outstanding on the date of this Agreement and such subordination is required under the loan documents providing for such indebtedness.

32. WAIVERS BY BORROWER

All parties to this Agreement including the Borrower and any sureties, endorsers, and guarantors hereby waive protest, presentment, notice of dishonor, and notice of acceleration of maturity and agree to continue to remain bound for the payment of principal, interest and all other sums due under this Agreement notwithstanding any change or changes by way of release, surrender, exchange, modification or substitution of any security for the loan amount or by way of any extension or extensions of time for the payment of principal and interest; and all such parties waive all and every kind of notice of such change or changes and agree that the same may be made without notice or consent of any of them.

33. EXPENSES

In the event any payment under this Agreement is not paid when due, the Borrower agrees to pay, in addition to the principal and interest hereunder, reasonable attorneys’ fees not exceeding a sum equal to the maximum usury rate in Nigeria, plus all other reasonable expenses incurred by Lender in exercising any of its rights and remedies upon default.

34. GOVERNING LAW

This Agreement shall be governed by, and construed in accordance with, the Laws of the Federation of Nigeria.

35. SUCCESSORS

All of the foregoing is the promise of Borrower and shall bind Borrower and Borrower’s successors, heirs and assigns; provided, however, that Lender may not assign any of its rights or delegate any of its obligations hereunder without the prior written consent.

36. Your loan application does not guarantee that the loan amount requested will be granted, whether fully or partially. The right to approval and funds disbursement resides with the Lender.

37. Loan up to 1M

- A) Eligibility Criteria

- Existing business must be in operation for one (1) year,

- Start-ups must be a registered business

- Provide CAC business registration documents.

- Company’s Bank Statement(s) for a period of one (1) year (for existing business)/ Chief Promoter’s (Director or Business owner) Bank Statement(s) for a period of one (1) year (for startups).

- Have required monthly turnover and other things as may be requested by the bank.

- B) Security

- Personal Guarantee of the promoter

- Acceptance of BVN Covenant (Global Standing Instruction- GSI), and any other thing that may be required by the bank

- C) Repayment Frequency

- Monthly equal installment (no moratorium) over a period of 3 years

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

38. Manufacturers up to N1billion (Working Capital or Asset Financing)

- A) Eligibility Criteria

- At least 6months business/ corporate banking relationship

- Provide CAC business registration documents

- 12 months bank statement for other bank

- Other documentations that may be required by the bank.

- B) Security

- As may be required by the bank

- C) Repayment term:

- i) Asset Financing

- 6 Months moratorium on principal and interest, 5 years repayment period for asset financing only

- ii) Working Capital Financing

- 12months equal installment of principal and interest

39. Apply here

https://loan.fedgrantandloan.gov.ng

40. Write a Business Plan for your business to Manage the loan to profitability and have enough money to pay back.

To write your business plan for this loan, including the detailed financial analysis, call any of our business plan consultants on 08105636015, 08076359735, and 08113205312. You can send a WhatsApp message or email us at dayohub@gmail.com or info@dayoadetiloye.com.

We help institutions and organizations write concepts, implement Business plans, and train on business Plan writing in Nigeria.

We can help you write a detailed, bankable and comprehensive business plan for your business idea and apply for any loan both local and foreign loans.

Call any of our business plan consultants on 08105636015, 08076359735 and 08113205312

Related