How to Answer Each Question of the Nigeria Youth Investment Fund NYIF 2024 Application and WIN the Grant, Loan and Equity Investment

Nigeria Youth Investment Fund

Nigeria Youth Investment Fund

The Nigeria Youth Investment Fund (NYIF) 2024 application process requires detailed and accurate responses to ensure eligibility and increase the chances of approval. Here’s a guide on how to answer each question effectively:

- BVN of the Cluster or Cooperative Members

- Answer: Enter the Bank Verification Number (BVN) of each member of your cluster or cooperative. Ensure that the BVN provided is accurate and matches the member’s bank details to avoid discrepancies.

- NIN of Cluster or Cooperative Members

- Answer: Provide the National Identification Number (NIN) for each member. This is crucial for identity verification, so double-check the numbers for accuracy.

- Correspondence Name

- Answer: Enter the name of the person who will act as the primary contact for your application. This should be someone responsible and easily reachable.

- Business Address

- Answer: Provide the physical address of your business. Ensure this is the address where your business operations are conducted and can receive correspondence.

- Correspondent Email Address

- Answer: Enter a valid and regularly checked email address for the correspondent. This email will be used for official communication regarding your application.

- Correspondent Phone Number

- Answer: Provide a phone number that is active and frequently monitored by the correspondent for timely communication.

- State of Business Implementation

- Answer: Indicate the state in Nigeria where your business operations or project implementation will take place.

- Years of Business Experience

- Answer: Specify the number of years you or your business have been in operation. This helps demonstrate your experience and reliability.

- Business Status

- Answer: Indicate whether your business is a startup, growing, or established. This should align with your business plan and goals.

How to Answer Each Question of the Nigeria Youth Investment Fund NYIF 2024 Application and WIN the Grant, Loan and Equity Investment

How to Answer Each Question of the Nigeria Youth Investment Fund NYIF 2024 Application and WIN the Grant, Loan and Equity Investment

10. Business Registration Status with the CAC

Indicate whether your business is registered with the Corporate Affairs Commission (CAC). If it is, provide details such as the registration number and date. This shows that your business is legally recognized.

11. Received Business Development Training (for cluster members)

State whether you or your cluster members have participated in any business development training. If yes, provide details about the training programs, including the institution, duration, and key learnings. This demonstrates your commitment to acquiring the skills necessary for business success.

12. Type of Business or Cluster Focus Area

Describe the primary focus or industry of your business or cluster, such as agriculture, technology, manufacturing, etc. This helps to categorize your business for appropriate support and resources.

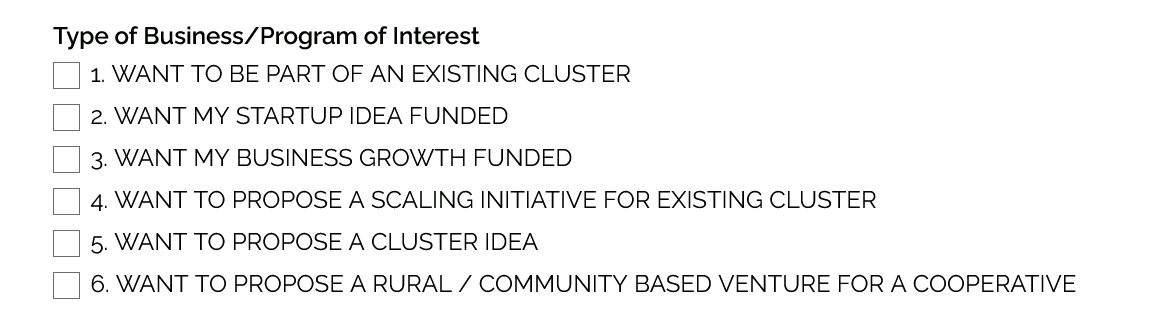

13. Want to Be Part of an Existing Cluster

Select this option if you want to join an already established business cluster. Provide details about the cluster, including its name and the benefits you hope to gain by joining it.

Click here to Apply https://www.fmyd.gov.ng/nyif_application

14. Want My Startup Idea Funded

Choose this option if you are seeking funding to launch a new startup. Be prepared to explain your startup idea in detail, including its unique selling proposition, target market, and potential for growth.

15. Want My Business Growth Funded

Opt for this if you need funds to expand your existing business. Provide specifics about your current operations, growth achievements so far, and how the additional funding will help scale your business.

16. Want to Propose a Scaling Initiative for Existing Cluster

Select this if you have a plan to enhance or expand the operations of an existing cluster. Detail your scaling initiative, including the expected impact and the resources needed.

17. Want to Propose a Cluster Idea

Choose this option if you want to create a new cluster around a specific business idea. Explain your cluster concept, including its goals, potential members, and how it will operate.

18. Want to Propose a Rural/Community-Based Venture for a Cooperative

Opt for this if you have a venture idea that benefits a rural area or community through a cooperative structure. Describe your venture, its target beneficiaries, and the expected social and economic impacts.

19. Brief Description of Your Business or Cluster

Provide a concise yet comprehensive overview of your business or cluster, including its mission, products/services, and target market. This gives reviewers a quick understanding of what your business is about.

20. Select Part of an Existing Cluster You Belong To

If you are part of an existing cluster, specify the cluster and your role within it. This helps to identify your network and collaborative efforts.

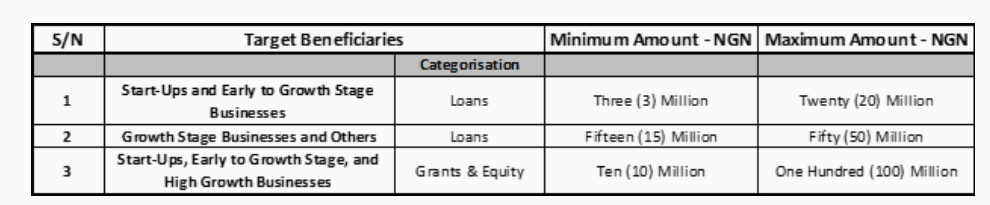

21. Amount Applied For

State the amount of funding you are requesting. Ensure this aligns with your business plan and justifies the need for the specified amount. Be realistic and precise.

22. Time/Period Repayment

Indicate the proposed repayment period for the loan or funding received. Be realistic based on your business’s cash flow and financial projections. A well-thought-out repayment plan shows financial responsibility.

23. Moratorium

Specify any requested moratorium period (the time during which repayment is not required). Justify the need for this period in your business plan, explaining how it will help stabilize your business.

Click here to Apply https://www.fmyd.gov.ng/nyif_application

How to Answer Each Question of the Nigeria Youth Investment Fund NYIF 2024 Application and WIN the Grant, Loan and Equity Investment

24. Business Plan (Max: 5 Pages)

Include an executive summary, general business information, product description, market access and marketing plan, management structure, financial information, and implementation schedule. Ensure it is concise and covers all essential aspects of your business.

Nigeria Youth Investment Fund

Nigeria Youth Investment Fund

25. Other Attachments

Attach necessary documents like the CAC document, state-level registration, or Community Development Associations Certification to prove your business’s legitimacy. These documents validate your business’s legal status.

26. Referee 1: Name, Address, Email, Workplace, and Portfolio

Provide detailed information about your first referee. This should be a credible person who can vouch for your business and character. Include their contact details and professional background.

27. Referee 2: Name, Address, Email, Workplace, and Portfolio

Provide similar detailed information about your second referee. Ensure that this referee is also credible and can support your application effectively.

28. Collateral Structure

Describe the assets you can offer as collateral for the funding. Be clear and precise about the value and ownership of these assets. This helps to secure the loan and shows your commitment to the business.

Conclusion

Filling out the NYIF 2024 application form requires careful attention to detail and accuracy. By providing thorough and precise information, you enhance your chances of securing the funding needed to grow and develop your business. Good luck with your application!

Click here to Apply https://www.fmyd.gov.ng/nyif_application

________________________________________________________________________

We can help you write a winning business plan for Nigeria Youth Investment Fund and delivered to you within 2-3 days. Call or Whatsapp us on 08060779290 or 08105636015 or send a mail to dayohub@gmail.com

We have Over 10 years experience in working with SMES and MSMEs to win grants, loans and raise Equity Investment.

You can download our company profile here https://dayohub.com/dabh-company-profile-copy.pdf

Related