How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to apply for loan of Nigeria Government

How to apply for loan of Nigeria Government

As a component of the Presidential Palliative Programme, the Federal Government of Nigeria has introduced two initiatives aimed at mitigating the impact of the fuel subsidy removal – the Presidential Conditional Grant Programme and the Presidential Palliative Loan Programme. The announcement came through a recent press release from Dr. Doris Uzoka-Anite, CFA, the Honourable Minister for Industry, Trade, and Investment.

Under the Presidential Conditional Grant Programme, the Federal Government will disburse a grant of N50,000.00 (Fifty Thousand Naira) to nano businesses across all 774 local government areas in the country. Collaboration between the Federal Ministry of Industry, Trade and Investment, Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), State and Local Governments, Federal Legislators, Federal Ministers, Banks, and other stakeholders is crucial for the successful implementation of this program.

Eligible nano business beneficiaries are required to furnish proof of their residential/business address in the local government area and provide pertinent personal and bank account information, including the Bank Verification Number (BVN) for identity verification.

President of Nigeria Loan

President of Nigeria Loan

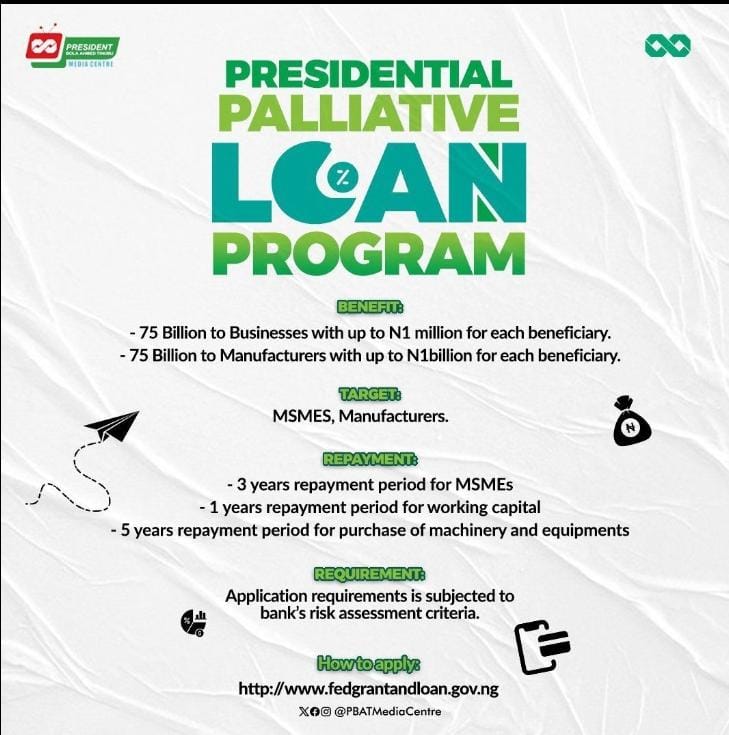

In parallel, the Presidential Palliative Loan Programme will allocate N75 billion to Micro, Small, and Medium-sized Enterprises (MSMEs) across various sectors and an additional N75 billion specifically to manufacturers. The loan, provided at a single-digit interest rate of 9% per annum, aims to support businesses in navigating the subsidy removal impact.

MSMEs can access loan facilities up to N1 million with a repayment period of three years, while manufacturers can access up to N1 billion for working capital, with a repayment period of one year for working capital or five years for the purchase of machinery and equipment.

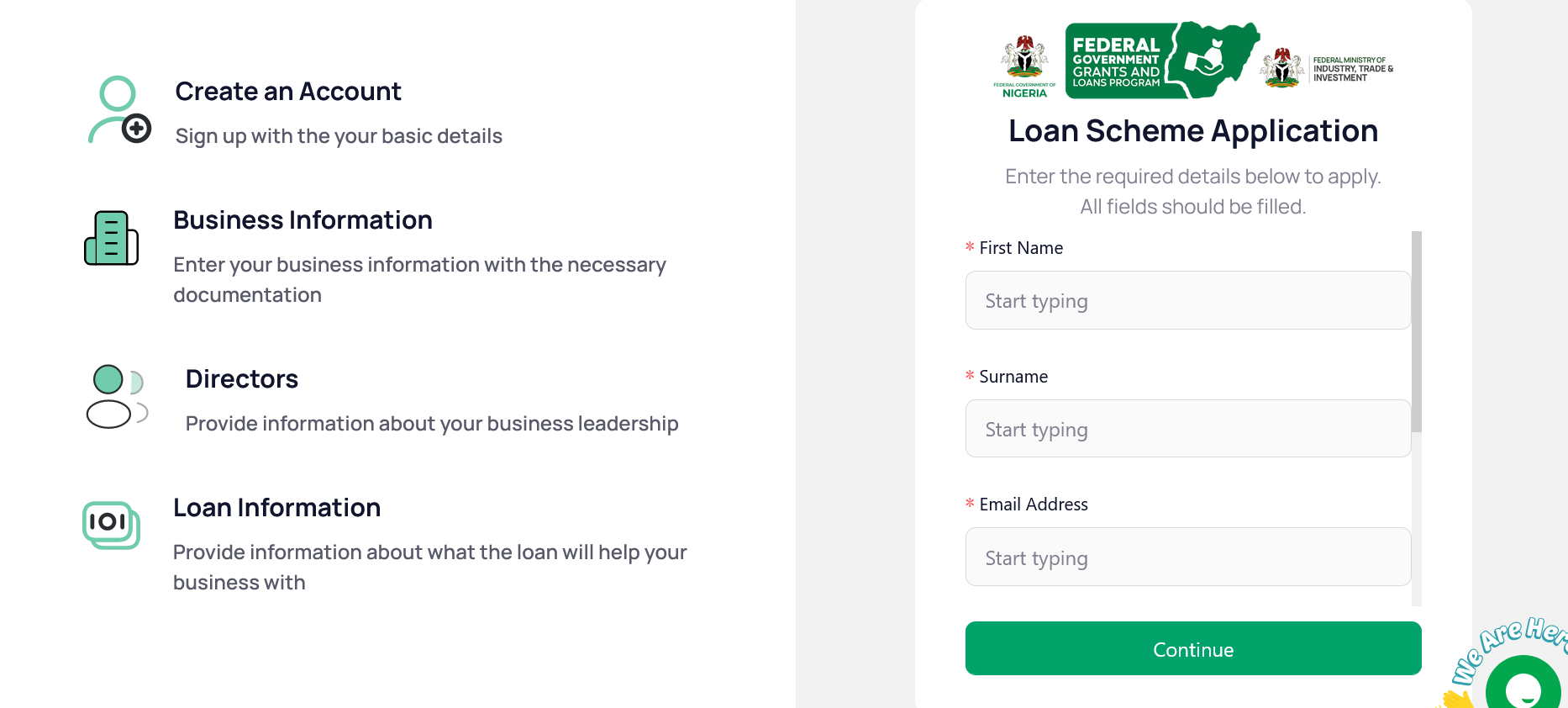

Interested MSMEs and manufacturers can submit their loan applications through the designated portal. The funds will be accessed through their respective banks, with applicants required to meet the risk assessment criteria set by their banks.

In line with its commitment to fostering economic development, entrepreneurship, and financial empowerment, the Federal Government anticipates that these initiatives will stimulate entrepreneurship and contribute to job creation.

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

What is a loan

A loan is a financial arrangement in which a lender provides money or assets to a borrower, who agrees to repay the loan amount along with interest or other agreed-upon terms over a specified period of time. Loans are a common way for individuals, businesses, and governments to access funds for various purposes, such as buying a home, starting or expanding a business, or covering unexpected expenses.

Key elements of a loan include:

- Principal: This is the initial amount of money borrowed, which must be repaid.

- Interest: Lenders charge interest as the cost of borrowing money. It is typically expressed as a percentage of the principal and is added to the amount the borrower must repay.

- Term: The loan term refers to the agreed-upon period over which the borrower is expected to repay the loan. Loans can have short-term or long-term durations.

- Repayment Schedule: The borrower and lender agree on a schedule for repaying the loan. This could involve regular monthly or quarterly payments.

- Collateral: Some loans are secured by collateral, which is an asset that the borrower pledges to the lender as security for the loan. If the borrower fails to repay the loan, the lender may seize the collateral.

- Interest Rate: This is the percentage of the loan amount charged as interest over a specific period.

Loans can be obtained from various sources, including banks, credit unions, online lenders, and financial institutions. The terms and conditions of loans can vary widely based on factors such as the borrower’s creditworthiness, the purpose of the loan, and prevailing market conditions.

It’s important for borrowers to carefully review the terms of a loan agreement, including interest rates, fees, and repayment schedules, before accepting a loan. Understanding these terms helps borrowers make informed decisions and ensures they can manage the financial obligation responsibly.

To Revolutionize Financial Support in Nigeria, The federal government is Introducing The Presidential Palliative Programmes – A Game-Changer in Economic Empowerment.

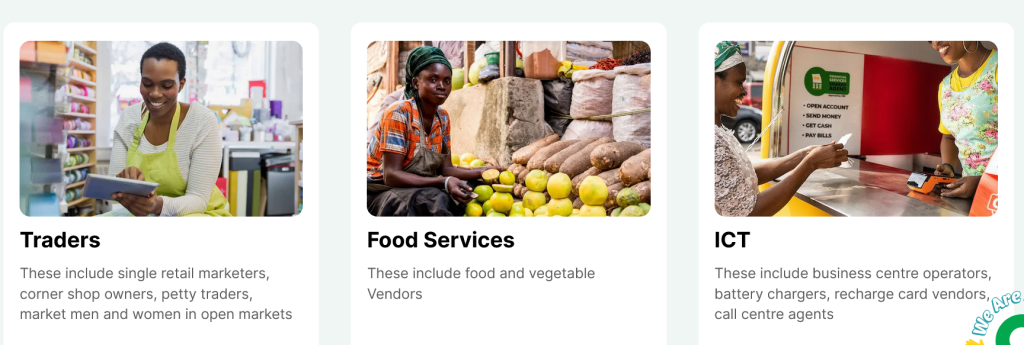

The Target Sectors

Below are the business that are eligible to apply to the scheme

Traders

These include single retail marketers, corner shop owners, petty traders, market men and women in open markets

Food Services

These include food, fruits and vegetable vendors, etc

ICT

These include business centre operators, battery chargers, recharge card vendors, call centre agents

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

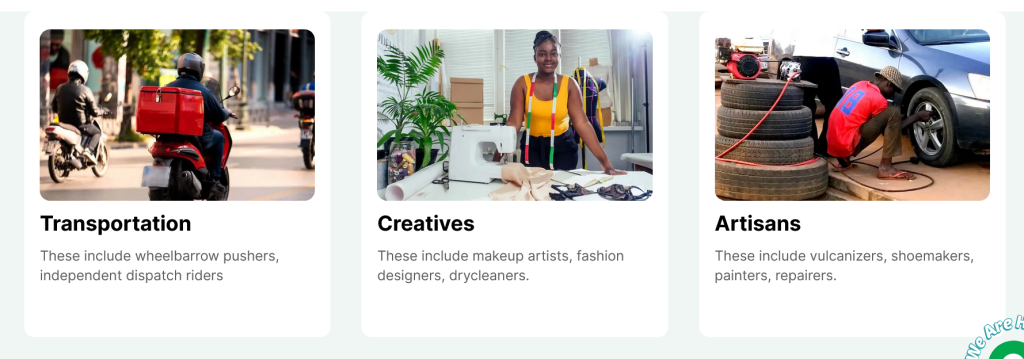

Transportation

These include wheelbarrow pushers, independent dispatch riders

Creatives

These include makeup artists, fashion designers, drycleaners.

Artisans

These include vulcanizers, shoemakers, painters, repairers.

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

Loan Eligibility Criteria

- Loan up to 1M

- A) Eligibility Criteria

- Existing business must be in operation for one (1) year,

- Start-ups must be a registered business

- Provide CAC business registration documents.

- Company’s Bank Statement(s) for a period of one (1) year (for existing business)/ Chief Promoter’s (Director or Business owner) Bank Statement(s) for a period of one (1) year (for startups).

- Have required monthly turnover and other things as may be requested by the bank.

- B) Security

- Personal Guarantee of the promoter

- Acceptance of BVN Covenant (Global Standing Instruction- GSI), and any other thing that may be required by the bank

- C) Repayment Frequency

- Monthly equal installment (no moratorium) over a period of 3 years

- Manufacturers up to N1billion (Working Capital or Asset Financing)

- A) Eligibility Criteria

- At least 6months business/ corporate banking relationship

- Provide CAC business registration documents

- 12 months bank statement for other bank

- Other documentations that may be required by the bank.

- B) Security

- As may be required by the bank

- C) Repayment term:

- i) Asset Financing

- 6 Months moratorium on principal and interest, 5 years repayment period for asset financing only

- ii) Working Capital Financing

- 12months equal installment of principal and interest

Key Features

Transparent and Efficient:

We prioritise transparency and efficiency, ensuring that funds are disbursed swiftly to deserving businesses.

Digital Transformation:

The platform leverages cutting-edge technology to make the entire process accessible through smartphones and computers, allowing SMEs to apply from anywhere.

Financial Literacy:

We understand the importance of financial education. Therefore, our platform provides resources and training to empower SMEs with the knowledge to manage their funds effectively.

Frequently Asked Questions

How do I access the loan?

Apply for the loan through the provided website www.fedgrantandloan.gov.ng while disbursement will be done by your bank if you meet the eligibility criteria.

How will I know if I qualify?

The criteria are provided on the website www.fedgrantandloan.gov.ng

What are the terms of the loan?

The loan term is 36 months for MSMEs and Manufacturers (Working capital) is 12 months, while Manufacturers (Asset financing) has a 60-month tenor with a six-month moratorium.

What if I don’t meet the criteria? Will I be considered?

No

What is the interest rate of the loan?

9% per annum.

Is there a moratorium period?

There is a six-month moratorium period for Manufacturers applying for asset financing only.

What if I can’t pay back the loan?

The bank will apply all legal measures to recover the loan from the borrower.

Can I apply with a partner company?

Applicant must have a registered business either as a Sole proprietorship, Partnership, or a Limited liability company

Is there an age limit to application?

Yes, applicants/promoters of the company have to be 18 years and above.

How long will it take from when I apply to when I get the loan?

This is dependent on your bank; however, it is typically expected to take 2 weeks.

Can I apply with different companies?

No, multiple applications will be disqualified.

What are the repayment terms?

Equal and consecutive monthly repayment of principal and interest for the tenor of the loan.

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How do I know the status of my application?

You can check the status of your application by logging into your profile. Once your application has been forwarded to your bank for processing, you should follow up with your bank for updates.

Can I reapply if my application is rejected?

You may be able to reapply if the reason for the rejection is a minor issue. You will be notified of the rejection and advised to provide additional information.

When is the deadline for the submission of applications?

Deadline will be communicated later.

Apply Now!

https://loan.fedgrantandloan.gov.ng/

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

How to Apply for Federal Government Loan through Presidential Palliative Programmes Transforming businesses, improving lives in 2024

Eligible applications who meet the selection criteria will be shortlisted.

Read Also: 30-list-of-grants-fellowships-entrepreneurship-training-programmes-you-can-apply-for-in-nigeria-in-2024

To write your business plan for this loan, including the detailed financial analysis, call any of our business plan consultants on 08105636015, 08076359735, and 08113205312. You can send a WhatsApp message or email us at dayohub@gmail.com or info@dayoadetiloye.com.

We help institutions and organizations write concepts, implement Business plans, and train on business Plan writing in Nigeria.

We can help you write a detailed, bankable and comprehensive business plan for your business idea and apply for any loan both local and foreign loans.

Call any of our business plan consultants on 08105636015, 08076359735 and 08113205312

Related