Step By Step Guide: How to Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

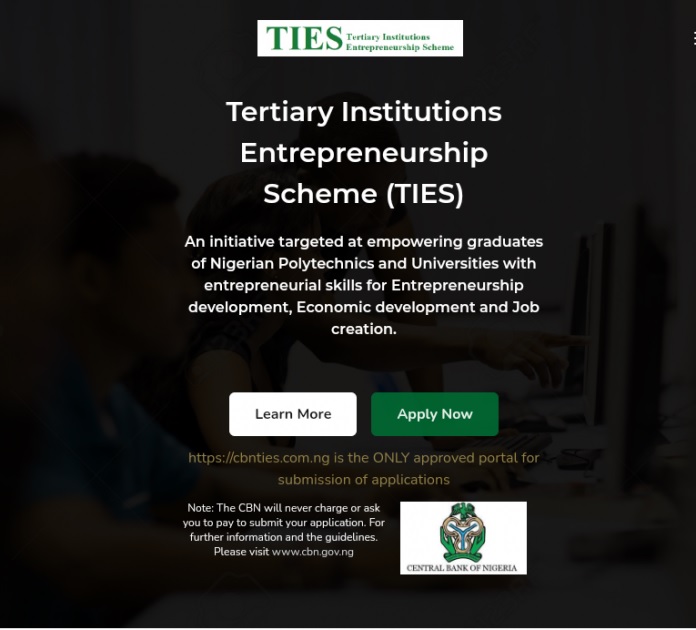

How to Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

How to Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

An initiative targeted at empowering graduates of Nigerian Polytechnics and Universities with entrepreneurial skills for Entrepreneurship development, Economic development and Job creation.

Introduction

The Central Bank of Nigeria, as part of its effort to boost economic growth and reduce unemployment among graduates of Nigeria Polytechnics and Universities, introduced the Tertiary Institutions Entrepreneurship Scheme. The Scheme is designed to create a paradigm shift among undergraduates and graduates from the pursuit of white collar jobs to a culture of entrepreneurship geared towards job creation, economic growth and sustainable development.

The Central Bank of Nigeria(CBN) therefore developed the Tertiary Institutions Entrepreneurship Scheme (TIES), in partnership with the academia( Universities and Polytechnics) to unleash the potential of the Nigeria graduate entrepreneurs (gradpreneurs) by providing re-orientation, training and an innovative financing model that will enhance the entrepreneurial ecosystem with transformational impact on the economy.

Objectives

The broad objective of the Scheme is to enhance access to finance by undergraduates and graduates of polytechnics and universities in Nigeria with innovative entrepreneurial and technological ideas. Other specific objectives of the Scheme include:

- Provide an enabling environment for co-creation, mentorship and development of entrepreneurial and technological innovations for value creation in partnership with Nigerian polytechnics and universities for the purpose of economic development and job creation;

- Fast track ideation, creation and acceleration of a culture of innovation-driven entrepreneurship skills among graduates of polytechnics and universities in Nigeria;

- Promote gender balance in entrepreneurship development through capacity development and improved access to finance;

- Leapfrog entrepreneurial capacity of undergraduates and graduates for entrepreneurship and economic development in partnership with academia and industry practitioners; and

- Boost contribution of non-oil sector to the nation’s GDP.

Key Performance Indicators

A comprehensive monitoring of specific benchmarks and key performance indicators (KPIs) under the Scheme shall be undertaken regularly. The KPIs (specific and relevant) shall include:

- Number of gradpreneur-led innovative start-ups and businesses with access to finance under the Scheme – 25,000 annually;

- Number of sustainable jobs created by gradpreneur-led businesses financed under the Scheme – 75,000 annually;

- Number of female-gradpreneurs financed as a percentage of total projects financed under the Scheme – 50 per cent per annum;

- Number of agropreneurs financed as a percentage of total projects financed under the Scheme – 40 per cent per annum;

- Number of creative entrepreneurs financed as a percentage of total projects financed under the Scheme – 20 per cent per annum;

- Number of Techpreneurs financed as a percentage of total projects financed under the Scheme – 20 per cent per annum; and

- Number of other gradpreneurs financed as a percentage of total projects financed under the Scheme – 20 per cent per annum.

Eligible Activities (Areas of Business)

The activities to be covered under the Scheme shall include innovative start-ups and budding businesses owned by graduates of Nigerian polytechnics and universities in the following areas:

- Agribusiness – production, processing, storage and logistics;

- Information technology – application/software development, business process outsourcing, robotics, data management;

- Creative industry – entertainment, artwork, publishing, culinary/event management, fashion, photography, beauty/cosmetics;

- Science and technology – medical innovation, robotics, ticketing

Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

NOTE: Trading activities shall not be eligible for financing under the Scheme.

Focal Components of TIES

The Scheme shall be implemented through three (3) components:

Term Loans

This shall be in the form of soft business loans. Only graduates of Nigerian polytechnics and universities that have undergone entrepreneurship training shall be eligible to participate under this Component.

Tier 1 – Sole Proprietorship

Description:

For sole proprietorship businesses, limited liability companies and small companies as defined by CAMA

Tenor:

5 years

Loan Limit:

N5 million

Interest Rate:

5% from now to February 28, 2022 ( and 9% from March 1, 2022)

Moratorium:

Maximum of 12 months (dependent on type of business)

Requirements

- Bank Verification Number (BVN);

- Verified first degree certificate (BSc/HND or its equivalent);

- Verified National Youth Service Certificate (NYSC) discharge or exemption certificate;

- Certificate issued by polytechnics and universities evidencing entrepreneurship training;

- Duly signed Global Standing Instruction (GSI);

- Third party guarantee: a senior federal/state civil or public servant, clergy, recognised traditional ruler, professionals (lawyers, doctors, accountants etc.), confirmed staff of established companies.

Tier 2 – Small Company / Enterprise

Description:

For Partnerships registered either as Limited Liability Companies and Small Companies as defined by CAMA

Tenor:

5 years

Loan Limit:

N25 million

Interest Rate:

5% from now to February 28, 2022 ( and 9% from March 1, 2022)

Moratorium:

Maximum of 12 months (dependent on type of business)

Requirements

The group shall apply as a business entity registered with the Corporate Affairs Commission (CAC) and certified true copies (CTC) of relevant forms submitted.

- Bank Verification Number (BVN);

- Verified first degree certificate (BSc/HND or its equivalent);

- Verified National Youth Service Certificate (NYSC) discharge or exemption certificate;

- Certificate issued by polytechnics and universities evidencing entrepreneurship training;

- Duly signed Global Standing Instruction (GSI);

- Third party guarantee: a senior federal/state civil or public servant, clergy, recognised traditional ruler, professionals (lawyers, doctors, accountants etc.), confirmed staff of established companies.

Repayment: Interest and principal repayment shall be made monthly on installment basis by the obligor to the PFIs according to the approved repayment schedule.

Developmental Component (Starting Soon)

The Developmental Component shall be disbursed in the form of Grants. The Grant shall be accessible by Nigerian polytechnics and universities through a biennial national entrepreneurship competition aimed at raising awareness and visibility of high-impact start-up ideas among undergraduates, promote entrepreneurial talent hunts in Nigerian polytechnics and universities and encourage innovations that are commercially viable and with transformational impact.

All About Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria 4

All About Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria 4

The top five (5) Nigerian polytechnics and universities with the best entrepreneurial pitches/ideas shall be awarded as follows:

| 1 |

First place |

N250.0 million; |

| 2 |

Second place |

N150.0 million; |

| 3 |

Third place |

N100.0 million; |

| 4 |

Fourth place |

N75.0 million; and; |

| 5 |

Fifth place |

N50.0 million. |

The grants shall be in the following areas:

- Agribusiness;

- Information technology;

- Creative industry; and

- Science and technology

Interested Nigerian polytechnics and universities shall apply on a dedicated online portal with brief details of the project, likely impact and evidence of originality of project.

Equity Investment Component (Starting Soon)

The Equity Investment Component shall be in the form of injection of fresh capital for start-ups, expansion of established businesses or reviving of ailing entrepreneurial businesses. The Component shall be implemented under the AgSMEIS Equity window.

Investment Limit: Subject to the limit prescribed in the AgSMEIS Guidelines. Investment Period: This shall be as follows:

- Investment made shall be for a maximum period of ten (10) years (not exceeding December 31, 2031).

- There shall be a 3-year lock-in period before exit in order to encourage value creation and boost managerial capacity of business, unless there is a material adverse event. iii. The Bankers’ Committee Trust shall hold the equity on behalf of the AgSMEIS Fund.

The equity investments shall be in enterprises operating within the eligible focal areas.

Here are the questions to Answer

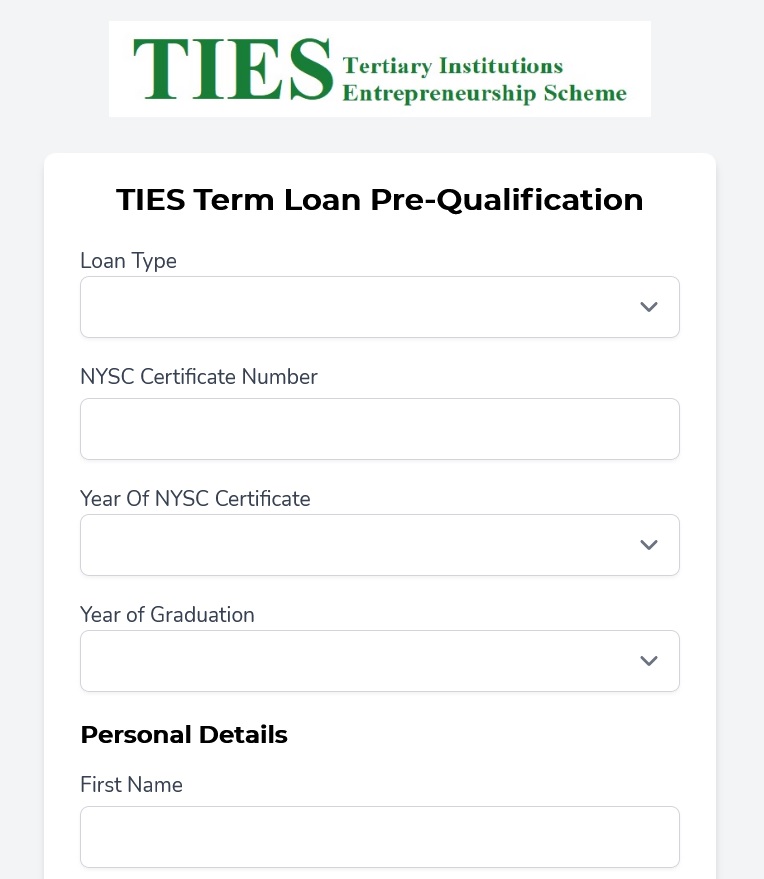

TIES Term Loan Pre-Qualification

Loan Type

NYSC Certificate Number

Year Of NYSC Certificate

Year of Graduation

Personal Details

First Name

Last Name

Email

Password

Confirm Password

Accept Disclaimer

- The loan applicant understands and expressly consents that the scheme may share any information, records or data provided in accessing the loan with relevant third parties such as; credit bureaus, consultants, other financial institutions, regulators, ports and law enforcement agencies, amongst others.

- The information exchanged will include the status of the applicant in relation to its credit history as to whether it is performing or in default as well as every other information that will enable the PFI to reach a fair conclusion on the application.

- Applicant further understands that this exchange will enable the scheme to broaden its product offering and improve the quality of its services to customer.

- Accordingly, any or all information so shared in relation to applications are given in good faith without liability whatsoever.

Read Also: All About Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Information to fill and submit

FACILITY DETAILS

Select Loan Type

Loan

Loan Type: Tier 1 – Sole Proprietorship

Description:

For sole proprietorship businesses, limited liability companies and small companies as defined by CAMA

Tenor: 5 years

Loan Limit: N5 million

Interest Rate: 5% from now to February 28, 2022 ( and 9% from March 1, 2022)

Moratorium: Maximum of 12 months (dependent on type of business)

Or

Select Loan Type

Loan

Loan Type:

Tier 2 – Small Company / Enterprise

Description:

For Partnerships registered either as Limited Liability Companies and Small Companies as defined by CAMA

Tenor:

5 years

Loan Limit:

N25 million

Interest Rate:

5% from now to February 28, 2022 ( and 9% from March 1, 2022)

Moratorium:

Maximum of 12 months (dependent on type of business)

Owner Verification

NIN

NYSC Certificate Number

BVN

APPLICANT INFORMATION

First Name

Middle Name

Surname

Gender

Date Of Birth

Mobile phone No

Personal Email

Marital Status

State of residence

Home Address

State of Orgin

Loan Amount

₦

GRADUATE INFORMATION

Year Of NYSC Certificate

Name of Higher Institution Attended

Programme of Study

Year of Graduation

Degree Certificate Number

Current Employment Status

Centre or University of Entrepreneurship Training

Year of Entrepreneurship

Entrepreneurship Certificate Number

Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Apply for Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Business INFORMATION

Has your Company been registered?

Yes

No

Project Information

Type of Business

Business Location

Project Sector

LGA of Business

Geo Political Zone

Attachments

(Max file size: 2mb)

CERTIFICATE OF INCORPORATION/REGISTRATION

MEMORANDUM AND ARTICLES OF ASSOCIATION (MEMART)

CERTIFIED TRUE COPY OF FORM CAC 2.5 (ALLOTMENT OF SHARES)

CERTIFIED TRUE COPY OF FORM CAC 2.3 (PARTICULARS OF DIRECTORS)

CERTIFIED TRUE COPY OF FORM CAC 2.1 (APPOINTMENT OF COMPANY SECRETARY)

MEANS OF IDENTIFICATION (I.E. PHOTOCOPY OF INTERNATIONAL PASSPORT OR DRIVER’S LICENSE OR NATIONAL IDENTITY CARD OR PERMANENT VOTER’S CARD)

FEASIBILITY REPORT/BUSINESS PLAN

QUOTATION/PROFORMA INVOICE FOR THE SUPPLY OF THE ITEMS OF MACHINERY & EQUIPMENT

Digital copy of Higher Institution Degree Certificate (Bsc/HND or equivalent)

Digital copy of NYSC Discharge Certificate

Certificate issued by Polytechnics or Universities evidencing entrepreneurship training

Duly signed Global Standing Instruction (GSI)

Download Template

Click here to apply

https://cbnties.com.ng/

Read also

5. All About Tertiary Institutions Entrepreneurship Scheme (TIES) by Central Bank of Nigeria

Related