How to apply for TraderMoni and MarketMoni (GEEP) by Federal Government of Nigeria in 2019

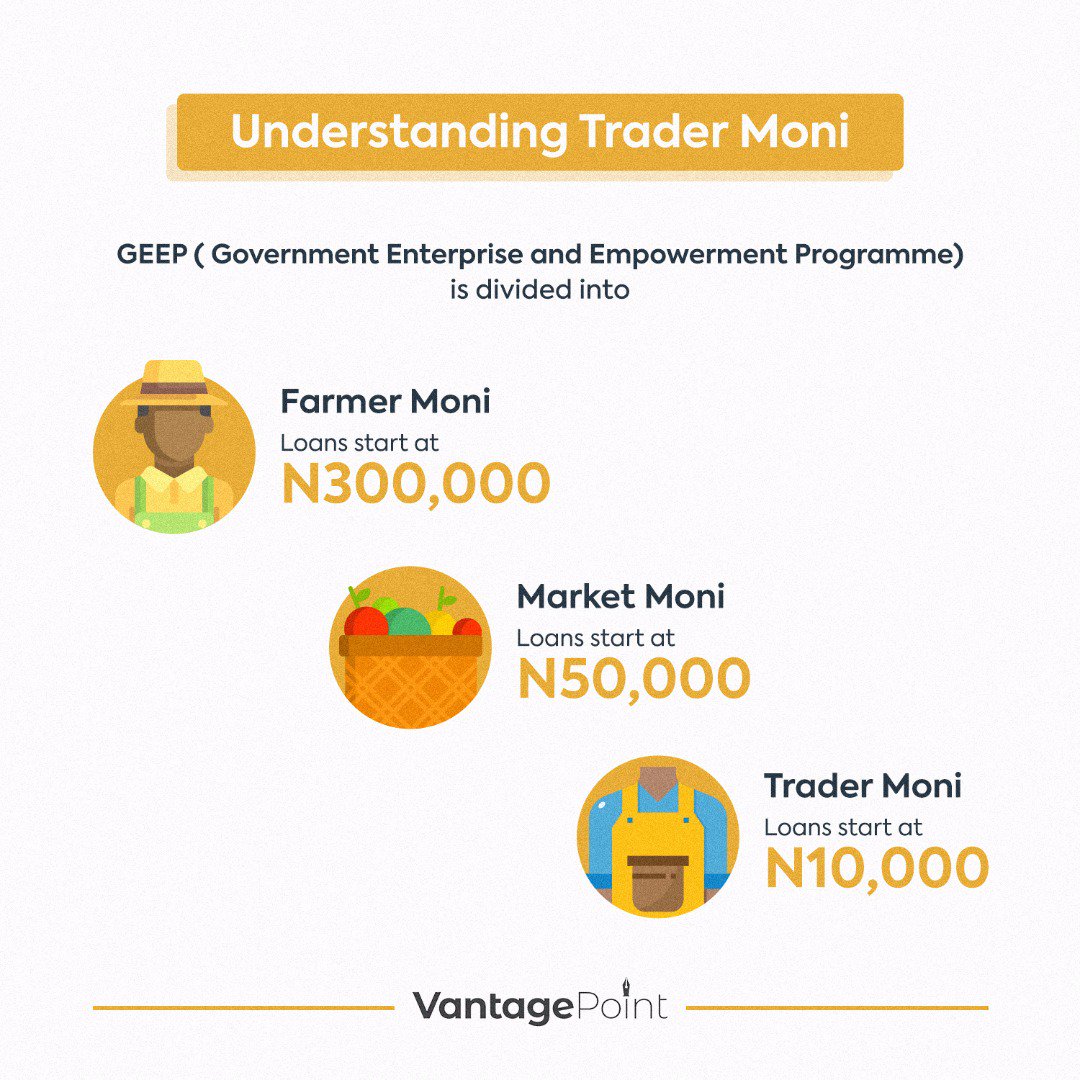

Federal Government has a program called the Government Enterprise and Empowerment Programme (GEEP) implemented by the Bank of Industry (BOI).

TraderMoni and MarketMoni

TraderMoni and MarketMoni

GEEP has Two pillers.

First is called #MarketMoni and the second is called #TraderMoni.

MarketMoni is a scheme for soft loans to small traders ranging from N10,000 – N100,000.

You decide the amount you need whether N10,000, N20,000, N50,000 or N100,000.

The repayment period is for 6 months and there is 5% administration fee. No interest is charged.

There is even a two weeks grace period to pay back. Once you finish paying, you can apply for a higher value or the same value.

That is basically left to you!

What are the requirements to apply?

- You must belong to a registered and accredited market Association or Cooperative which must be registered with BOI.

- You must have BVN.

- Your market Association or Co-operative must nominate you for a loan and stand as your guarantor.

- You must have a business location.

So basically to access #MarketMoni, you need to belong to a market association or a cooperative. Because the money will be disbursed through your Cooperative. And you can borrow up to N100,000 as many times as you can pay back.

TraderMoni and MarketMoni

TraderMoni and MarketMoni

Now let’s talk about #TraderMoni.

#TraderMoni is a mobile phone driven initiative. Unlike #MarketMoni, you don’t need to be a member of a cooperative to access it.

While MarketMoni targets micro traders that are a bit structured (i.e. belong to an Association), TraderMoni is targeted at the ultra-micro enterprises.

With #TraderMoni you can access N10,000 and pay back N10,250 to qualify for N15,000. Once you payback N15,375 you will qualify for N20,000 loan, when you pay back N21,000 you will get N50,000.

The repayment period remains for 6 months with zero interest charged.

How do you get registered?

You need a mobile phone. Once your details are captured by agents and sent to BoI system for validation, you’ll within 48hrs get cash notification in your mobile wallet account.

You can either transfer to your bank account or cash at mobile money agent around.

So in a nutshell while #MarketMoni gives out from N10K – N100K (with requirements of belonging to a registered cooperative), #TraderMoni gives us loans from between N10K – N50k without that requirement.

The repayment period remains the same (6 months ) and you can return several times

Now…why starting from N10k for both #MarketMoni and #TraderMoni (even though you can apply for higher than N10k if you wish)…the reason is simple.

The people targeted for this loans are at the Micro Level.

In 2013, NBS and SMEDAN did a survey and they found out that ..The total number of

MSMEs in Nigeria stood at 37,067,416,

Micro – 36,994,578,

Small – 68,168, and

Medium – 4,670.

68.35% of this number (i.e. 23.3m MSMEs) initial start-up capital was predominantly less than N50,000.

This was the justification and it was based on data not politics or BUYING vote like some mischievous and disgruntled elements have posited

You may ask, why not N1m or N10m or N50m?

TraderMoni and MarketMoni

TraderMoni and MarketMoni

It is because there are already other intervention funds like the CBN MSMEDF which gives from N500,000 to N50m to SMEs. To access this fund, you need a business plan, you need to be registered with CAC and you need collateral.

How many market women, artisans and traders do you know who can prepare a business plan, register their business with CAC and have sufficient collateral to attract the CBN’s N220 Billion SME loan?

Aside from this, the BOI also has a similar loan targeted at SMEs as well.

So what has been happening is that the big SME’s with the strength to do so have been able to access the other intervention funds targeted at SMEs, but those at the micro level have been unable to do so mainly because of structural reasons.

This is why they were targeted with GEEP

So the idea that this is some vote buying scheme is ridiculous.

If the Government can help these people scale up by supporting their business with micro credit, they benefit, the economy benefits with higher GDP and we all benefit.

Dr. (Mrs) Jumoke Oduwole.

Click here to apply Marketmoni.com.ng

Related