How to write financials of a business plan

How to write financials of a business plan

How to write financials of a business plan

Writing a business plan can be very challenging and daunting and one of the aspects of the business plan that makes it a tasking document to prepare is the financials section of the business plan. The financials of a business plan is one aspect of the document where great care must be taken to ensure accuracy and correctness because errors in the financials of your business plan means your decisions would be wrong from the onset, especially if you are a new startup. If you are ever planning to attract investors or you’ll need a business loan from lending institutions, your application or request would be an automatic “No” without the financials. This is one key area that these people are first interested in before even checking on the other sections of your business plan. If the financials of your business plan is non-existent or poorly written, either way, you can’t get your way with these people.

What is the financials section of a business plan?

The financials of a business plan is that section in the business plan document where the writer describes the financial history of the company (if it’s an existing company) or the financial projections of the business if it’s a new startup. Financial history is a record of how a company performed financially in the past while financial projection is an assumption (although this is meant to be substantiated by supporting facts and figures) about what the financial performance of a company will be in the future. The financial section of the business plan is usually the last section of the last in the document but that doesn’t make it the least important section. If anything at all, it is perhaps the most important section in your business plan.

Why is financials important in a business plan?

You would agree with me that some importance of the financials of a business plan have been highlighted already in the first few paragraphs above, however, I will try to make a quick list below for you to drive home the benefits.

- It is an important performance driver: It is important to visualize how well your business is faring or to plan how well you want your business to do, in monetary terms.

- It is necessary should you be interested in attracting investors or seeking lending opportunities. Without it, you can’t do any of these.

- It helps you make day-to-day decisions that move your business in the direction of success. Without the financials being tracked, operating business is like taking on a lethal fight in a dark room – too dangerous!

- It helps you compare your projections to the actual results you’re getting.

- It helps you determine the overall financial health and efficiency of your business.

- It is a good tool for budgeting

- It helps prepare your business for a smooth tax experience.

- It helps you to easily determine the financial needs of your business

- It is a tool for business growth

What do you need to write the financials of a business plan?

As I have said earlier, when considering writing financials, you either writing for an existing business or a startup. As a startup, a very straightforward way to kick-start your financials is by tracking your income and expenses – that’s the basics. To keep things simple, especially if you have not been keeping records or you are not sure the records you have is complete or accurate, you can track for a whole month or two and use that data to project over a period of time, say six months, one year or so. If you are a startup, you can also make some projections based on market data you must have gathered. Whichever way, the basic data (or projection as the case may be) of income and expenditure is very fundamental to writing your financial – just the same way you can’t construct words or sentences without the alphabets.

From your simple data of income and expenditure (over a period of time), the following statements must be generated or projected, and they are the ones which the components or building blocks for your financial plan

- The income statement

The income statement is a financial statement that captures or shows the revenues you have generated (or will generate), the expenses you have incurred (or will incur), and the profit you have made (or will make), over a period of time. This is one tool that immediately tells you or anyone who cares to know, whether your business is (or will be) profitable or not. The income statement uses the simple calculation of revenue less expenses to show profit or loss.

Read Also: How to be an affiliate for a business plan writing company

How to write financials of a business plan

How to write financials of a business plan

- The cashflow statement

This is another important statement which any business needs to be successful. The cashflow statement tracks the details of the movement of money into, and out of, your business. If you want to know whether your company has so much cash to do this or that (or not enough, or nothing at all), it is your cashflow statement that tells you what’s up. In order words, the cashflow statement is what tells you how much cash your business can access now for whatever needs to be done. The cashflow statement is a beautiful thing because it helps you know how much you have, or lack – so if you need to take some loan to cover expenses, your cashflow statement immediately tells you how much will be needed. Your cashflow statement is also one of the ways investors determine whether your business is worthy of investment or not.

- The balance sheet

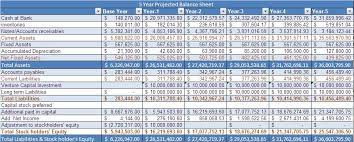

The balance sheet is another important component of the financials of a business plan. It shows the net worth of your business in summary. It provides a quick way of knowing what your business owns and what it owes – i.e. your assets and liabilities – at a given point in time. This helps your company to manage its debts smoothly and plan constructively for growth. The balance sheet presents three things namely, assets, liabilities, and equity. Assets are tangible objects or things owned by the company and have monetary value. Liabilities are the debts owed by the company and equity is the difference between a company’s assets and liabilities.

Tieing it all together

Like I said in the opening part of this article, what you need to focus on as a business owner is the proper documentation of your daily transactions – basically, tracking your income and expenses. This is what we refer to as bookkeeping in accounting. Now, to generate the financial statements and the other things needed for the financials of a business plan, accounting knowledge is required. Therefore, if you do not have any accounting knowledge, you may need the help of an accountant to generate those statements. Alternatively, you can use some accounting software or Microsoft Excel templates. This is even a simpler part of the job. Finally, there is a need to interpret what the statements you have generated are communicating in terms of the financial standing or financial performance of your business. These interpretations are actually what goes into the financials section of your business plan while the statements themselves will be part of the appendices. However, you can use charts, diagrams, and images to corroborate your presentation of the information extracted from the financial statements.

If you need a service of a Professional Business plan writer, then Dayo Adetiloye Business Hub is the place to go Call or WhatsApp us now on 081 0563 6015, 080 7635 9735, 08113205312 or send an email to dayohub@gmail.com and we will solve any of your business plan problems.

Hope you enjoy this article?

Share your thoughts in the comment session.

Contact us today for your business consultancy and business advisory services. We can help you fine-tune your idea, structure your business, market your business, train your staff, consult on your retirement plan, coach you for financial success. We also write a business plan and help with fundraising strategies and Grant applications. We can help you start, grow, and expand your business.

Call or WhatsApp us now on 081 0563 6015, 080 7635 9735, 08113205312 or send an email to dayohub@gmail.com and we will solve any of your business problems.

Related