PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

How to Save and Invest with PiggyVest in Nigeria

How to Save and Invest with PiggyVest in Nigeria

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

- Why do I have to add my BVN?

Your BVN is required to validate your identity and kick against identity theft. This ensures another level of safety for your funds and transactions.

It also unlocks other features like transfers from your Flex to another user’s Flex account.

- What if I no longer have access to the phone number linked to my BVN?

In a situation, where you no longer have access to the phone number linked to your BVN, kindly contact your bank to update the phone number.

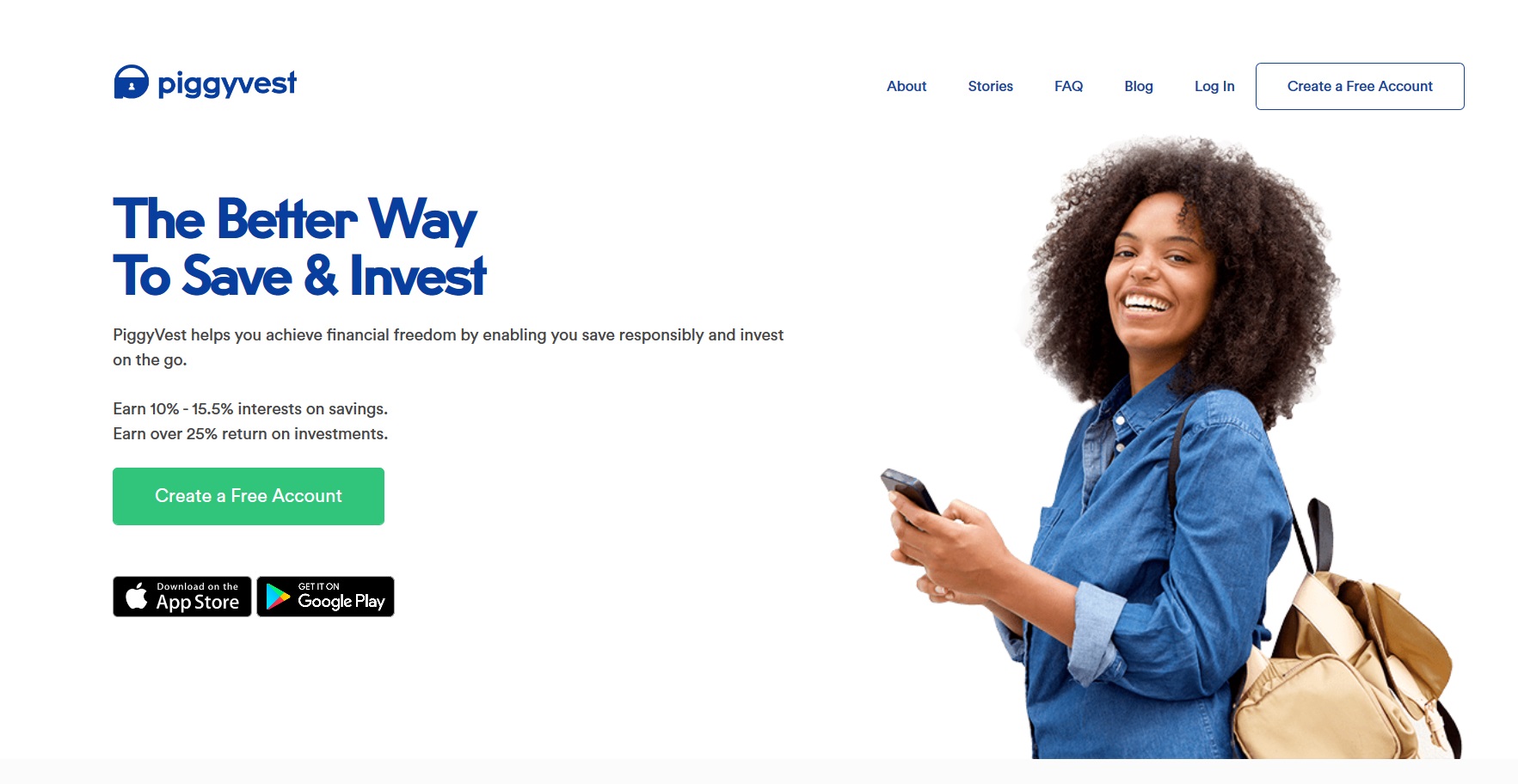

PiggyVest (formerly piggybank.ng) is a simple app that helps you save and invest with ease. With PiggyVest, you can stop spending excessively and put away (and grow!) funds that you do not want to touch.

You can choose to save little amounts of money periodically (Daily, Weekly or Monthly) towards a specific target OR lock away funds for a specified period of time. Click here to start Saving with PiggyVest

We take away the stress by combining simplicity, discipline, convenience, and flexibility to enable you to manage your finances better and achieve financial freedom.

- How do I know what is right for me?

If you’d like to regularly put away money for your savings and withdraw only once a quarter, then the Piggybank wallet is right for you. You can set it so that money is taken from your account and you don’t have to worry about saving manually.

If you’re saving towards a particular goal such as rent or travel, Target Savings is a great option. You can invite friends and make it a fun challenge to smash all your financial goals.

If you’re looking for something geared towards the long term, The SafeLock feature is perfect for you. With higher interest rates, you could lock away funds you don’t need access to and make even more money by doing so.

If you’re looking to get started on investments or diversify your portfolio, then pre-vetted, low-risk investment opportunities are regularly available on Investify to help you grow your money.

- How do I start saving in piggyvest?

Visit the website or download the app to create an account.

Set up your withdrawal account details; this is the bank account that funds you withdraw will get sent to.

Enter your debit card details to activate your account and then make your first deposit. (You may use a MasterCard, Visa or Verve card from any Nigerian bank).

You may now proceed to use any of the Savings Plans to start your daily, weekly or monthly savings.

- Are there bank charges when you deduct from my account?

No! its completely FREE. There are no bank charges for transferring money to your piggyvest account.

- How much can I start with?

You can ONLY save between:

N50 – N50,000 daily,

N1000 – N200,000 weekly,

or N3,000 – N500,000 monthly

However, you can always top up your savings at any time using the Quick save option which allows you to add up to N500, 000 per time.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

Safety and Security

All financial information is encrypted and stored to PCIDSS Level 1 compliant standards. PCIDSS Level 1 compliance is a set of rules stated by credit card companies and audited by an independent third party.

It is the highest possible rating one can get in the electronic payment processing industry. Additionally, all transmission to our banking partner and on our site is via an encrypted 256-bit HTTPS SSL connection.

Yes! We are located at Tesmot House, 3 Abdulrahman Okene Close, off Ligali Ayorinde, Victoria Island, Lagos.

Contact Number: 0700 933 933 933

Email: contact@piggyvest.com

Your security is our major priority, so we work with a PCIDSS-compliant payment processor, Paystack to handle your card details.

Your card details are extremely safe and are warehoused where they can never be compromised.

Click here to start Saving with PiggyVest

How secure is my money?

As Piggybank.ng, we operated in partnership with 2 Microfinance banks and used their licenses. However, in early 2018, we acquired Gold Microfinance bank and its license. We are also a registered cooperative- Piggytech Cooperative Multipurpose Society Limited (Registration number, 16555).

All saved funds are warehoused with and managed by AIICO Capital, the leading asset management company in Nigeria, registered and licensed by the Securities and Exchange Commission (SEC).

PIGGYBANK™ SAVINGS

No, everything is done automatically once you have set up your Auto save, except you want to top up your savings using the QuickSave option.

To keep track, all transactions on your debit card will be visible on your dashboard. We will also send an email receipt to you every single time you save with your card, and your bank will send you an alert as well. It’s 100% secure.

We WON’T automatically debit your account if you missed any day, week or month and we WON’T charge you either. The QuickSave option is always available for you to manually make up for any lost day, week or month.

Yes, you can, it is up to you to pause or continue the automatic saving any time for free. Login to your account, go to your Savings and select “Turn off Autosave” from the Piggybank savings option.

Click here to start Saving with PiggyVest

Yes, you can increase the amount you’re saving at anytime. Simply login and click ‘modify AutoSave instruction’, then edit the amount. You can also edit your frequency to either daily, weekly or monthly.

What if I don’t have funds in my account or debit card?

Simple! We will not be able to debit you for that day, week or month. We will only be able to save for you when you have funds in your debit card. However, you have the option to use the “Quick save” option once you have loaded your account.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

This option basically enables you to add more funds to your savings. For example, if you set N1,000 daily and you miss a day or two, you can use the quick save option to deposit N2,000 or N3,000 at once. This is to ensure you meet up with your savings target.

You can add up to N500,000 at once with this option. However, you can add this multiple times in a single day. For instance, if you want to add N1,000,000, you need to add N500,000 twice.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

INVESTIFY

Investify is a PiggyVest feature that allows users to earn more on their savings by investing in pre-vetted, low-medium risk, primary and secondary investment opportunities.

Yes, we make sure that each investment listing on PiggyVest comes with its own protection and coverage.

Investment minimums vary by investment opportunities.

Insurance coverage varies by investment opportunities.

You can fund your investment using your debit card and Flex wallet.

All investment opportunities listed on PiggyVest are pre-vetted for maximum safety. We carry out due diligence on all investment partners.

All investment options aggregated on Piggyvest Investify have been properly vetted for insurance against loss. However, PiggyVest Extra Protection can be added to your investment for maximum capital safety.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

It varies on the opportunity you’re choosing to invest in. Your interest could be paid daily, monthly, quarterly OR at the end of the investment period into your PiggyFlex account.

PiggyVest Extra Capital Protection is an added layer of security provided by PiggyVest that ensures your capital is protected.

We don’t handle taxation. You, however, are liable to disclose your earnings and pay your taxes as stipulated by the government.

Yes, you can.

However, to liquidate, you will need to trade the units you have already acquired with other existing investors or potential new investors.

You set the price but a platform commission exists and it varies between 1% – 3% depending on the type of investment.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

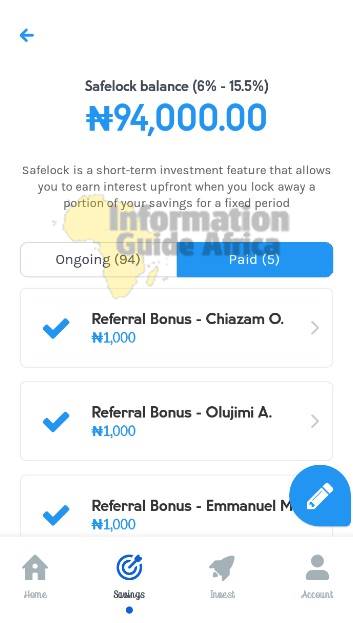

SAFELOCK

SafeLock is a fixed savings option that allows you to earn up to 15.5% per annum, usually paid up front.

Your Safelock acts as your sub-account so that you can transfer and lock funds from your Piggybank wallet or your debit card for at least 10 days, without access to these funds until maturity.

The SafeLock feature is one step further towards curbing the temptation to touch money that you have put aside as your savings.

SafeLock interests are prorated and paid for the duration you set.

On funds locked for:

10-30 days, the interest is calculated at 6% per annum and prorated for the duration you set.

31-60 days, the interest is calculated at 8% per annum and prorated accordingly

61-90 days, the interest is calculated at 10% per annum and prorated accordingly

91 days- 2 years, the interest is calculated at 13% per annum and prorated accordingly.

2 years and above, the interest is calculated at 15.5% per annum and prorated accordingly.

The minimum amount that may be kept in SafeLock is N1000.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

Can I have more than one SafeLock?

Yes, you can have more than one SafeLock; and you can give them different names (purposes) too.

E.g. You can have a SafeLock for your Fees, Wedding; Birthday; Vacation etc.

Yes, your SafeLock is different from your normal savings plan. After initiating a SafeLock for a particular amount of money, your savings plan continues as normal.

It is completely under your control. You set the pace, duration and everything else concerning your SafeLock.

Yes, you can. Simply ensure the duration of the existing locked fund is above 90days. Select the particular SafeLock, click on “Top-up” and enter the amount.

PS: You can only top up your safelock with funds from your Piggybank wallet. Your interest would be prorated and paid based on the remaining days.

Upon maturity, all funds that you have put in Safelock get sent to your Flex Naira wallet.

No, funds can only be accessed upon maturity.

In cases where you may want to close your account completely, you’ll have to wait until funds mature from your SafeLock before you can liquidate.

The maximum amount per Safelock is #100m.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

TARGET SAVINGS

With Target Savings, you are able to save consistently towards a particular financial goal. You can create a personal target or a Group savings challenge with your multiple users.

Save for your rent, vacation, a new gadget and even towards starting your new business with Target savings, and earn more money while at it!

How do I activate/create a Target Savings

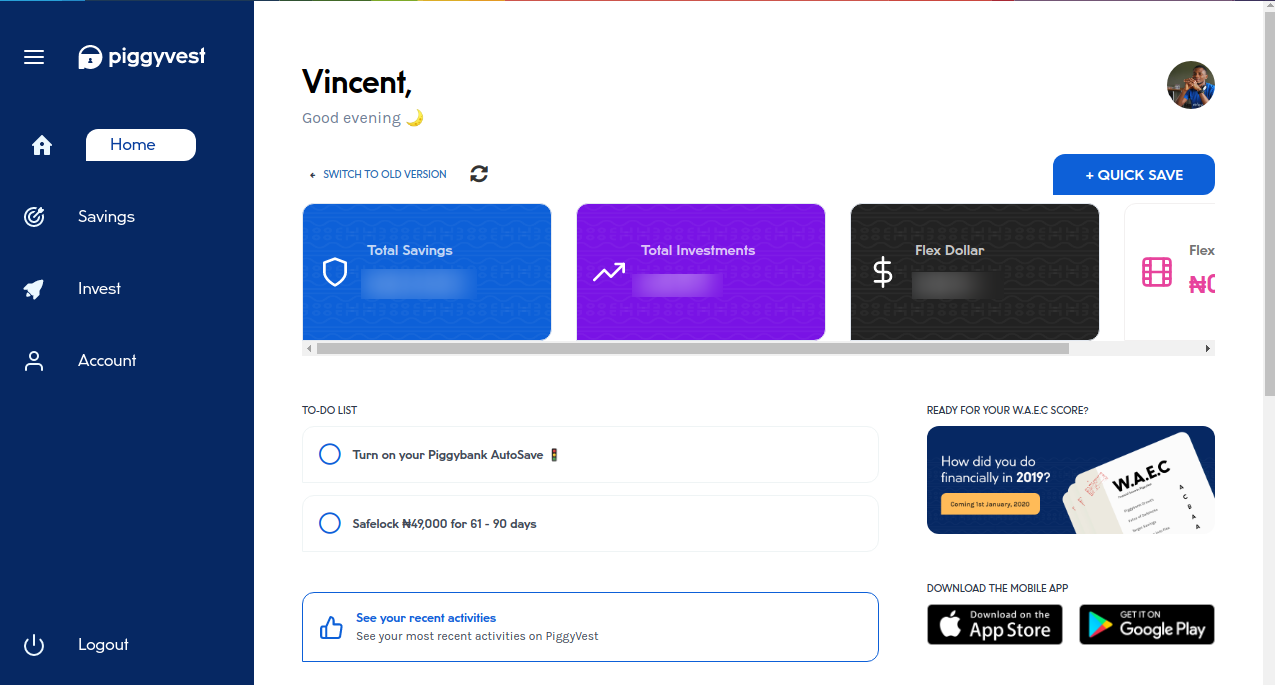

Log in to your dashboard and click on the ‘Savings’ sign on the bottom pane of your dashboard.

Click on the ‘Targets’ option and then ‘Create a Target’.

Select the Target option you’d like, fill in the required fields and save the Target to activate it.

You can invite friends to join your Target at any time.

Yes, you can.

Simply log into your dashboard and select the ‘Target Savings’ option on your dashboard. Click on ‘Ongoing Targets’ and then select the target you would like to end and select ‘Break’.

Funds will then be sent to your Flex wallet, and you will be able to access these funds.

However, if you break these funds before the maturity date, you will lose your accrued interest and also be charged a 1% processing fee. If you do not achieve the target amount by the maturity date, you will only lose your accrued interest.

P.S: You cannot break a locked target. Funds can only be accessed at the maturity date. In cases where you may want to close your account completely, you’ll have to wait until your target matures.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

Read Also: Simplified-book-keeping-for-Entrepreneurs

INTERESTS

YES.

10% per annum on Piggybank

Up to 15.5% per annum on SafeLock

10% per annum on Target

10% per annum on Flex

6% per annum on Flex Dollar

Up to 25% on Investify

Kindly note that interest rates are subject to change at any time based on market conditions.

Core Savings (Piggybank)- Interest is accrued daily on your balance, and paid monthly (available from the 1st of every month).

SafeLock- Interest is paid upfront into your Flex account and you can access it immediately for free.

Target Savings- Interest is accrued daily and is paid at the end of your target.

Users who do not want to earn interests on their savings can disable interests.

To do this, simply login to your account, go to Account >> My Account settings >> Interest settings >> Disable Interest on Savings >> Update settings.

Our operational costs are relatively low – we do not operate multiple branches or hire a lot of staff to manage operations. We are also able to negotiate premium rates due to volumes.

All saved funds are warehoused with and managed by AIICO Capital, the leading asset management company in Nigeria, registered and licensed by the Securities and Exchange Commission (SEC) which is extremely safe and guaranteed. A portion of the proceeds is then passed on to users as interests on their savings.

FLEX NAIRA

A Flex Naira account is a flexible savings wallet where interests earned on all other PiggyVest wallets are paid.

You earn an interest of 10% per annum on funds in your flex account but this is subject to a minimum of 4 withdrawals in a month.

If you withdraw more than 4 times a month from your Flex account, you lose all your accrued interest on your Flex savings for that month.

Additionally, you can fund your Piggybank, Target, Safelock, Flex Dollar or Investify using funds in your Flex.

On your free withdrawal days, you can also withdraw from your PiggyBank savings to your Flex Account.

P.S: You can ONLY withdraw once every 10hours from your Flex account.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

Yes! you can! And it’s absolutely FREE.

However, you can withdraw once every 10hours. This is for security reasons and to also encourage financial discipline of our users.

Can I transfer from my Flex Naira account to my Piggybank (core savings)?

Yes, you can! Simply click on “Use Funds” and then select the option to transfer back to Piggybank (core savings).

How to fund my Flex Naira account

To fund your Flex account, simply link your BVN to your Piggyvest account to get your unique Flex account number. Once this is done, log into your banking app, input this account number in the required field and select Providus bank as the recipient bank.

Follow through with the required steps for funds to be transferred from your bank account to your flex account.

FLEX DOLLAR

Flex Dollar is a feature that lets you save, invest and transfer funds in Dollars.

You can fund your Flex Dollar account from your Flex Naira wallet or your bank card.

All you need to do is select an amount in Dollars you would like to purchase, then select a funding source and complete the transaction.

You can fund your Flex Dollar account with as little as $1.

Yes! You get up to 6% per annum on your PiggyVest Flex Dollar account.

Interest rates are determined by the market behaviour at any given time.

You can withdraw in Naira or Dollars. Withdrawing in Naira will be at the stated parallel market buy rate. When withdrawing in Dollars, the funds are sent to your Dollar-denominated domiciliary bank account.

There are no charges for withdrawing into your Naira account from your Flex Dollar account.

However, payments into domiciliary accounts attract charges which are stated on the platform.

Interest on your Flex Dollars is accrued daily but paid monthly. You can get up to 6% per annum on the funds in your Flex Dollar wallet.

Interest is also compounded monthly.

Flex Dollar funds are invested in dollar fixed term investments with Anchoria Asset Management, a division of VFD group. Anchoria Asset Management is licensed by The Securities and Exchange Commission (SEC), Nigeria.

Their investment products focus on capital preservation while providing income and asset class diversification.

No, not for now.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

WITHDRAWALS

You can withdraw for FREE only on set Withdrawal dates. You can set your own FREE withdrawal dates OR you can make use of the PiggyVest quarterly fixed FREE withdrawal dates.

After the request has been made, funds would be sent to your bank account and can also be sent to your Flex Naira account instantly and then you can withdraw to your set bank account anytime.

PS: If you decide to set your own convenient FREE withdrawal date, the next available FREE date will be exactly 3 months from your last free withdrawal day.

You can choose your own FREE withdrawal dates on your dashboard.

OR You can use Piggybank’s FREE withdrawal days which are:

31st March

30th June

30th September

31st December

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

PiggyVest Frequently Asked Questions(FAQs) and How to Save and Invest through PiggyVest.

Any day outside the Withdrawal days will attract a 5% penalty fee.

Yes, you can, just go to the withdraw page and enter how much you want to withdraw. Click here to start Saving with PiggyVest

You need to have filled your bank details in your withdrawal settings then, click on the “withdraw” option on your dashboard, enter the amount you want to withdraw and your funds will be transferred to your set bank account within the stipulated time (not more than 3 working hours).

The minimum amount you can withdraw from your Piggybank is N3000 and there is NO maximum. You can withdraw all of your funds whenever. However, fixed free withdrawal dates still apply.

PS: You can ONLY withdraw once in 24hours.

Yes, transfers from your Piggybank wallet to your Flex account count as a withdrawal

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

PIGGY POINTS

PiggyPoints is a way of rewarding our users for saving consistently. The more you save in your Piggybank wallet (using either Autosave or Quicksave), the more you earn.

You start to earn points when you save at least N2,000 at once in your Piggybank wallet directly from your debit card ONLY

N2000 – N4999 = 1 point

N5000 – N9999 = 2 points

N10000 – N49999 = 10 points

N50000 – N99999 = 25 points

N100000 and above = 55 points

You can now convert your Piggy Points to cash in your Flex Account

1 Piggy Point = N10.

REFERRAL PROGRAM (STORIES)

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

When someone signs up to PiggyVest using your referral link, you and the person you have referred each earn N1000, which is paid into your SafeLock. This matures to your flex account after 10days once the referred user is marked valid.

As a new user, your bonus will be paid into your SafeLock and matures to your flex account 10 days after you have been marked valid.

To be considered valid, a new user must:

Link their BVN and fund their Flex Naira wallet with at least #100 via a direct bank transfer to their flex account number

Fund any other two wallets with at least #1000 each. This could be Piggybank, Safelock, or Target savings wallet.

Once all of these have been done, referral bonuses will be unlocked and sent to your flex account at the maturity date.

To check the status of people you referred, login to your Piggyvest dashboard, select Account > Earn N1000 per invite > Click on each name to see if they’re valid.

Delete Promo Safelock

- What is the “Delete Promo Safelock” button for?

If for any reason, you no longer want the referral bonus, you can click on this button and the bonus will be deleted from both the referrer and the referred user’s account.

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

MOBILE APP

Yes! The mobile app is available ONLY on Android and iOS.

Click here to start Saving with PiggyVest

Use PiggyVest to save & invest securely. Sign up with my link and get ₦1,000.00 to start your own savings journey – https://app.piggyvest.com/?newref=1&ref=477cc5d05d0720

Instruction after signing up to redeem your free N1000

Hello. When someone signs up to Piggyvest using your referral link, you and the person you referred both get N1000 each in your safelock.

This gets sent to your flex account 10 days after the referred user has been marked valid. To be considered a valid user, your referral would have to

Have:

1.) Linked their BVN to their Piggyvest account

2.) Funded their flex naira wallet with at least N100 from their bank account using their flex account number

3.) Funded any other two wallets with at least N1000 each. Wallets may be Target savings, safelock, piggybank

4.) Leave funds untouched for at least 10 days.

Once all these are done, your referral safelock gets unlocked and sent to your flex naira wallet. Your referral safelock will roll over every 10 days until all the requirements are met.

Read Also: How-to-save-and-invest-with-piggyvest-in-Nigeria

Related