What are the Benefits of Internal Control in Business?

What are the Benefits of Internal Control in Business

What are the Benefits of Internal Control in Business

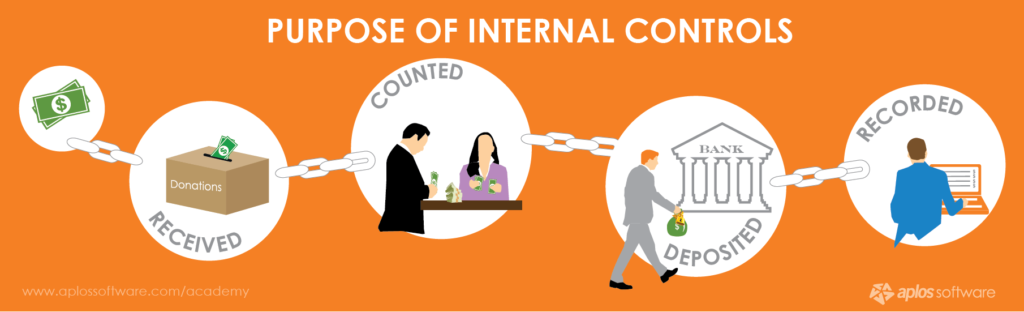

In the accounting field, internal controls are measures that are practiced to help monitor the resources of a company so that they meet their financial goals and at the same time making sure that all appropriate protocols are met.

The process of initiating an income earning opportunity from scratch is an uphill task for young entrepreneurs as well as well-established entities. However, the fact that an enterprise is successfully launched doesn’t guarantee instant rewards and benefits in terms of revenue generated, customer satisfaction, product and service performance in the market.

Consequently, there are sublime sophisticated techniques that can be applied to an organization to assure its existence, continuity and overall growth.

Internal control is an auditing and accounting phenomena characterized by monitoring, establishing quantity and transactions revolving around assets of an organization. In addition, internal control or operational control is a necessity any business institution should effect in order to combat arising risks as a result of commercial activities.

Operational control is a collective responsibility of both employees and company management officials such as CEOs, Board of Directors and Auditors.

This article provides comprehensive insight in the privileges businesses exposed to internal control enjoy.

What are the Benefits of Internal Control in Business

What are the Benefits of Internal Control in Business

- Internal Controls Prevent Fraud

Internal controls help to protect against mismanagement or fraud. Revenue loss due to fraudulent activities orchestrated by employees is a risk susceptible to any company irrespective of its size.

Inasmuch as employers entrust delicate financial records to employees it is disastrous to rule out the fact that they can’t be tempted to contaminate and manipulate data to their advantage.

Internal control provides plans or programs that can be actualized to safeguard business entities from possible occurrence of fraud. Ideal examples of operational control involve requesting an employee for receipts before dispatching a reimbursement expense.

Banks require companies to provide them with authentic signatures of personnel authorized to approve checks for the sole purpose of verifying before paying. Documentation is a great source of fraud and employers should regularly review purchase orders, checks and invoices to ascertain and pinpoint any source of error that exhibits potential fraud.

Prevention of fraud is a decent practice because cleaning up the mess after a fraudulent occurrence is an expensive affair!

- It Reduces Lawsuit and Insurance Claims

Liability insurance is an essential component that eases’ operations of a company since its benefits increase the level of trust between employer and employee creating a serene environment for a thriving business.

On the other hand, an employee can commit a deliberate mistake that ends up tarnishing an organization’s reputation, legal lawsuits and immense financial losses resulting from compensations as well as insurance premiums.

In recent years the number of lawsuits arraigned against employers has been on an increase prompting firms to design, implement policies and regulations that govern code of conduct of employees. These guidelines are internal control practices that comply with the state’s workplace laws.

- Internal Control Helps in Identifying and Preventing Errors

Organisations depend on certain systems to be able to produce goods or render services for her prospecting and existing customers by minimizing expenses through risk management practices. COSO framework is a comprehensive organization of management that includes CEO, Board of Directors.

The system operates on the basis of integrating input from every employee that is used in internal control. It in cooperates managers in every unit whose role is to supervise operations and device methods used in minimizing errors that might result from production process or during service delivery.

In production operational control practice involves confirming and testing quality by performing tests on goods before they are dispatched to consumers. Early detection of errors is a maintenance practice that aims at improving quality thus preventing issues from going overboard. Revising and going through financial data is a good internal control method of eliminating errors if any.

What are the Benefits of Internal Control in Business

What are the Benefits of Internal Control in Business

- Internal Control Encourages Compliance

Complying with laws and regulations as stipulated by the state should be adhered with to the latter. In the event a company fails to obey acceptable standards set by a state, local government and county then the institution is at a risk of facing possible legal suit.

For instance, the first crucial legal step undertaken before venturing into a business activity is registering the company and her name. Operating an unregistered entity is an illegal affair that’s punishable by law.

A proper internal control process ensures that customer information is protected from third party interference thus stemming relations between customer and enterprise. Undefined contracts are a possible case that can greatly disadvantage a company.

Therefore, it’s vital to stipulate the type of agreement employees and employers strike including terms and conditions prior to commencement of an activity.

Conclusion

Internal control is a proper strategy catering for both employees and employers. The above benefits are legitimate, factual and are credited to operational control strategies imposed on firms.

Consequently, for regulatory responsibilities to be implemented and end up being successful the management plays a big role by engaging and rallying up employees to practice the regulations.

It is the mandate of an Auditor to set the trend by providing means by which internal control can be improved, sophisticated to suit a business model.

Abe Oluwasegun is a small business consultant. He blogs at Startupback. You can mail him at catfishnigeria@gmail.com or follow him on Twitter here: @Agrodynamix

Related